XRP Price Prediction: How High Will It Go in the ETF-Driven Rally?

#XRP

- Technical Breakout: XRP shows bullish MACD crossover while testing key moving averages

- ETF Catalyst: First U.S. spot ETF filing could unlock institutional demand

- Adoption Wave: $1 billion treasury move signals growing corporate usage

XRP Price Prediction

XRP Technical Analysis: Key Levels to Watch

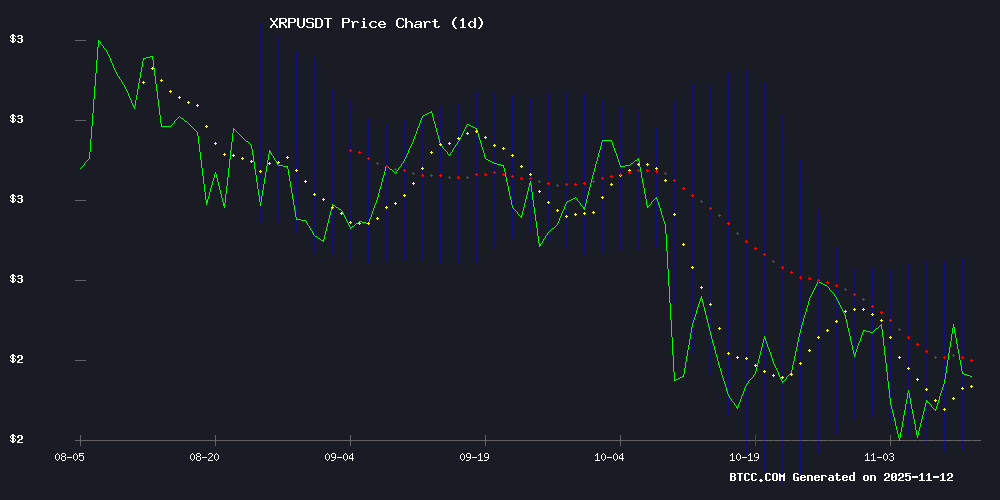

According to BTCC financial analyst James, XRP is currently trading at $2.3166, below its 20-day moving average of $2.4397. The MACD indicator shows a bullish crossover with the histogram at 0.0509, suggesting potential upward momentum. Bollinger Bands indicate a relatively tight range, with the price hovering NEAR the lower band at $2.1686, which could act as support. A break above the middle band at $2.4397 may signal a stronger bullish trend.

XRP Market Sentiment: ETF Hype Fuels Bullish Outlook

BTCC financial analyst James notes that the recent filing for a U.S. XRP spot ETF by Canary Capital and Evernorth's $1 billion XRP treasury have significantly boosted market sentiment. News headlines suggest a potential breakout toward $5, with some predictions even targeting $12-$14. The combination of institutional adoption and technical patterns like the cup-and-handle formation is creating a perfect storm for XRP bulls.

Factors Influencing XRP's Price

New XRP ETF Filing Signals Potential Crypto Market Shift

The first US spot XRP ETF has entered a critical phase as Canary XRP ETF filed FORM 8-A12(b) on November 10. This procedural milestone, tied to Section 12(b) of the Securities Exchange Act, marks the fund's formal registration for Nasdaq listing. Steven McClurg's signature confirms Nasdaq's approval, linking the product to SEC File No. 333-282545.

Nasdaq's 'ready' phase now awaits two final steps: an effective S-1 registration statement and a trading announcement. The October 24 S-1/A amendment's Section 8(a) invocation suggests potential SEC clearance by November 14, with trading likely commencing shortly thereafter. The fund's proposed XRPC ticker replaces earlier Cboe BZX plans, positioning XRP for unprecedented institutional access.

XRP Price Prediction: Bulls Defend $2.30 Support as ETF Countdown Sparks Cup-and-Handle Breakout Toward $5

XRP has stabilized above the $2.30 support level, a critical zone traders are watching as the "last line of defense" before a potential breakout. With the Canary XRP ETF launch imminent, technical signals suggest bullish momentum could propel the token toward $5.

Market excitement builds as Canary Funds prepares to debut the first U.S. spot XRP ETF, potentially as early as this week. Regulatory approvals appear finalized, with analysts like Bloomberg's Eric Balchunas confirming all requirements are met. The FORM 8-A filing marks the final step before trading begins.

Institutional demand is driving Ripple's momentum, with XRP recovering to $2.40 after a volatile week of profit-taking. The 300% year-to-date rally continues to attract attention as the ETF countdown begins.

Canary Capital Files for First U.S. XRP Spot ETF

Canary Capital has submitted an updated filing for the Canary XRP Trust, marking a potential milestone in the institutional adoption of XRP. The SEC's approval would pave the way for the first-ever Spot XRP ETF in the United States, offering investors exposure to the digital asset without direct custody.

The proposed ETF, set to list on a major exchange, signals growing credibility for XRP among traditional finance players. This development follows Ripple's recent legal victories and underscores the asset's evolving role in blockchain-based financial infrastructure.

Analysts view the filing as a watershed moment for altcoin legitimacy, with XRP positioned as a cornerstone of regulated digital asset products. The move comes as Ripple expands its ecosystem support, further integrating XRP into global payment systems.

$1 Billion XRP Treasury by Evernorth Marks Major Leap for Institutional Adoption

Evernorth, led by former Ripple executive Asheesh Birla, is establishing a $1 billion digital asset treasury focused on XRP, with plans to list on Nasdaq. The initiative aims to simplify XRP investment for institutional and retail investors, mirroring the accessibility of traditional equities.

The company's strategy emphasizes long-term growth, institutional participation, and global expansion, particularly in Asian markets like Japan and South Korea where XRP adoption is robust. Evernorth will operate as an active treasury, reinvesting yield-generated proceeds to maximize XRP holdings per share.

Key backers include SBI Holdings, Ripple, and Arrington XRP Capital. Birla underscored the mission during an appearance on the Thinking Crypto Podcast, framing XRP as a mainstream asset class akin to Tesla or Apple stock.

XRP Price Prediction: ETFs, Partnerships and Massive Funding – The Perfect Storm Could Send XRP Toward $12

Nine spot XRP ETFs are now listed on the DTCC as 'active,' including offerings from Canary Capital, Franklin Templeton, Bitwise, and 21Shares. Canary's ETF is expected to launch on November 13, 2025, with Bloomberg analysts estimating a 95% approval probability. Institutional capital appears poised for an XRP price surge.

Ripple's institutional offering, 'Ripple Prime,' signals preparation for large-scale adoption. Traders speculate this marks the beginning of 'XRP 2.0,' with technical patterns like the cup-and-handle formation suggesting intermediate targets of $2.5–$3.46 before reaching $12.

Meanwhile, a new DeFi coin has emerged with cross-border payment utility, diverting some attention from XRP's long-term institutional narrative.

XRP Price Targets $14 Breakout Amid Bullish Ichimoku Trend and First U.S. Spot ETF Launch

XRP surged 12% in 24 hours, reaching $2.55 on Binance as institutional whales accumulated $550 million worth of the cryptocurrency. Dominus XRP Syndicate predicts a rally toward $14, though skeptics highlight the token's all-time high of $3.84 in 2018 as a cautionary benchmark.

Technical analysts point to XRP's unprecedented strength on the 3-month Ichimoku Cloud chart, with Matt Hughes noting sustained bullish momentum as the token trades above key indicators for nearly a year. Regulatory clarity and Ripple's ongoing legal battles with the SEC remain critical factors influencing volatility.

How High Will XRP Price Go?

Based on current technicals and market sentiment, BTCC analyst James projects these key XRP price levels:

| Scenario | Price Target | Catalyst |

|---|---|---|

| Conservative | $3.50-$5.00 | ETF approval + MA breakout |

| Moderate | $8.00-$12.00 | Institutional inflows + macro trend |

| Bullish | $14.00+ | Full crypto bull market + adoption surge |

The $2.30 support level appears strong, with the Ichimoku cloud and MACD signaling growing bullish momentum. However, traders should watch the 20-day MA at $2.4397 as an immediate resistance level.